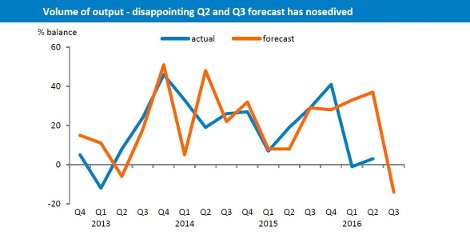

The latest Printing Outlook survey reveals that whilst just over one-third of printers (35%) maintained output levels in the second quarter of 2016, 34% experienced a fall in output and 31% were able to increase output. The resulting balance (the difference between the ups and the downs) was +3; up from -1 in Q1 but some way below the forecasted balance of +37, and the lowest Q2 balance since 2012.

The output balance of +3 was significantly below the forecast of +37 for Q2. Now a balance of -14 is forecast for the coming three months.

On this occasion it is a marginal positive balance in output that is expected to be short-lived. Just over one-fifth of respondents do still expect to increase output levels in Q3, however 44% predict that output levels will remain the same and 35% expect output to decline in Q3. The forecasted balance of -14 would, if realised, be a significant downturn from recent performance. Indeed it would be the lowest output balance since 2009, in the aftermath of the financial crisis.

The balance between those believing that the general state of trade improved, and those believing that it had deteriorated, was -10 in Q2; down from the +2 in Q1, and some way below the Q2 forecast of +30. The negative balance for Q2 has come from 25% believing the general state of trade in the printing industry had improved and 35% reporting that there had been deterioration. 40% reported no change in the general state of trade in Q2 2016. Despite the negative overall balance some encouragement can still be taken from the fact that almost two-thirds viewed confidence in the general state of trade in the printing industry in Q2 as either stable or improving.

As with output and orders, the stranded Q1 and Q2 forecasts have lent to a pessimistic forecast for Q3. Confidence is not expected to return just yet. However, as last quarter, exactly half of respondents believe that the general state of trade in the industry will remain unchanged. It is the other half that is affecting the balance – 12% expect that the UK printing industry will improve in Q3, and 38% expect that it will deteriorate.

The balance of -10 was a sharp downturn on the forecast of +30. A balance of -26 is forecast for the coming three months.

Competitors pricing below cost continues to be the most voiced business concern – though by a smaller margin than previously; it was selected by nearly two-thirds (64%) of respondents as one of their top three business concerns. Concerns regarding profit levels being insufficient to encourage investment remains the second ranked concern (26% in Q2, down from 27% in Q1). The under-utilisation of capital equipment has now emerged as the third ranked concern – this was selected by 26% of respondents in Q2, up from only 22% in Q1.

It is fair to say that ‘Brexit’ had some influence over the responses to this question – it was specifically mentioned by almost all of the respondents in the ‘Other’ category. Furthermore, it is more than likely to have influenced the growth in respondents selecting private sector cutbacks (from 5% in Q1 to 21% in Q2) and possibly for paper and board prices (from 10% to 24%). It also seems possible that referendum campaigning may have boosted the selection of over-regulation / red tape (from 4% to 22%).

Kyle Jardine, BPIF Research Manager, said:

“Overall the figures are quite negative, there’s no getting around that. Also, a lot of this has been attributed to uncertainty both pre and post referendum – and the surprise of the Brexit outcome. However, as we are all aware, print is a strong industry which is capable of adapting to change – though there will undoubtedly be winners and losers. We will shortly be conducting a post-referendum survey to gain further insight as Brexit becomes a reality, and will continue to communicate with members on this important topic.”

Charles Jarrold, BPIF Chief Executive, said:

“It is the confidence in the general state of trade in the printing industry that has taken the biggest hit. Confidence was only marginally positive in the survey previous to this; conducted in April, a few months before the EU referendum. However, this survey – conducted in July and starting a week after the referendum – shows that confidence ebbed in Q2, amidst the pre-referendum uncertainty. On this occasion there is no optimistic forecast for the quarter ahead.

“The printing industry has often been said to be a bellwether for the general state of the economy; and whilst the direct link to GDP performance is now arguably lost, there is still mileage in the argument that the industry remains to be an early indicator of many trends in the wider economy.

“On a brighter note – when asked about the current position of their business, many respondents have continued to respond with more positive sentiments. Almost half (49%) of all respondents reported that their businesses are expanding.”

Summary of key findings:

- Increased levels of uncertainty in 2016 are evident and there have now been successive quarters in which output forecasts were left high and dry by the harsh reality; expectations for Q3 have been radically downgraded.

- Confidence in the general state of trade in the printing industry has taken a big hit.

- Competitors pricing below cost continues to be the most voiced business concern – though by a smaller margin than previously.

- Capacity utilisation in July was less than in April; a majority were in the 70-79% and 80-89% ranges.

- Recruitment remained positive in Q2, though at a lower balance level than in Q1 and Q4 prior to that.

- There was no let-up to the downward pressure on prices in Q2.

- Whilst the majority of respondents have continued to report stable input costs in Q2, cost pressure has mounted – this is expected to accelerate in Q3. Labour was the main cost pressure in Q2 but, as predicted, more respondents are experiencing upward cost pressure for paper.

- The positive expectation for margins was dashed as more printers were subject to shrinking margins in Q2.

- Exporters continued to experience growth in Q2.

- Intentions for investment in the year ahead have weakened further in Q3.

- The availability of bank lending has continued to improve and exposure to bad debt has fallen.

- Over two-fifths (42%) of respondents reported that they had conducted a pay review in Q2; awarding increases averaging 2%.

- UK demand for printing papers and boards decreased by 3.7% in Q1 2016 in comparison to Q1 2015.

Also in Printing Outlook this quarter:

- Pay Reviews – activity and average % changes.

- Investment – tracking intentions for plant & machinery, training & retraining, product & process innovation and buildings.

- Data on capacity, productivity, costs, margins, investment and more.

- Consumables – paper consumption data and printing ink volumes and values.

Printing Outlook is available (free to BPIF members and £40 to non-members) from the BPIF website.