Large Format Review (LFR) is delighted to announce the results of its large-scale survey of the print, sign and display markets, with HP and Orafol leading the way in terms of innovation and product reliability, respectively.

Launched in July this year, the ‘Wider Perspective 2025’ survey sought opinion from industry professionals across the UK, Germany and the US. More than 3,100 people responded, offering their opinion on several major topics and talking points.

HP and Orafol claim top spots in customer perception voting

In the ‘Technology of Print’ section, professionals were asked their opinion on which manufacturers they thought were the most innovative when it came to wide-format print. It was closely contested with HP scoring just ahead of Epson, and Mimaki taking third place on the winners’ podium.

Within the same section, respondents were also asked about which printable material brands and products they consider to be the most reliable. Orafol polled an impressive approval rating of 82% for overall print performance and reliability. Meanwhile, Arlon also scored well to take second place, with third place in this category going to Metamark.

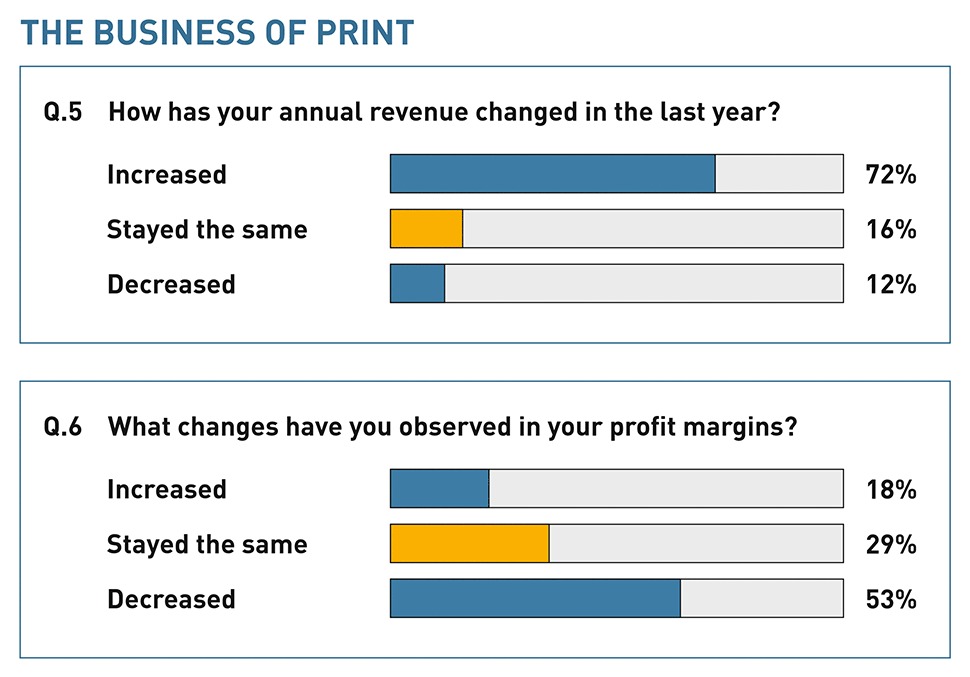

Higher revenues, lower profits

Switching to the ‘Business of Print’, this revealed some sense of positivity, with 72% of respondents saying they had seen revenue increase in the past year. However, just 18% had seen profit rise on the back of this, with 53% reporting a decline.

Looking ahead, 41% of companies said they were “very optimistic” about business prospects over the next two years, compared to 11% that said they were “very pessimistic”.

Also on this subject, respondents said higher salaries and benefit expectations from staff was their primary challenge, ahead of the reliability of consumables including ink and media.

The survey also revealed that 38% of respondents would consider new technology investment within the next 12 months. In addition, more than half of the companies surveyed said they were already using artificial intelligence to support their business.

The eternal hardware question: Eco-solvent vs UV vs Latex

While eco-solvent is still dominant in terms of print technology currently owned and operated, when printers were asked about their likely future investments, UV and Latex scored by far the highest, suggesting that the eco-solvent reign as the technology of choice could be on the wane.

Artificial Intelligence use is growing and will continue to grow

Artificial Intelligence is a hot topic currently. 57% of respondents said they are already using AI in some form or another with the primary aims being to improve operational efficiency and enhance customer service.

Of those that haven’t yet adopted AI, it was concerns about lack of internal know-how, lack of clarity on costs and potential issues integrating with existing systems that were responsible for 85% of the resistance. Only 9% said they saw no need for AI in their business, so we’d expect to see adoption of AI continue at pace in the foreseeable future as users’ knowledge of AI increases and the obstacles to adoption are removed.

Mixed thoughts on sustainability

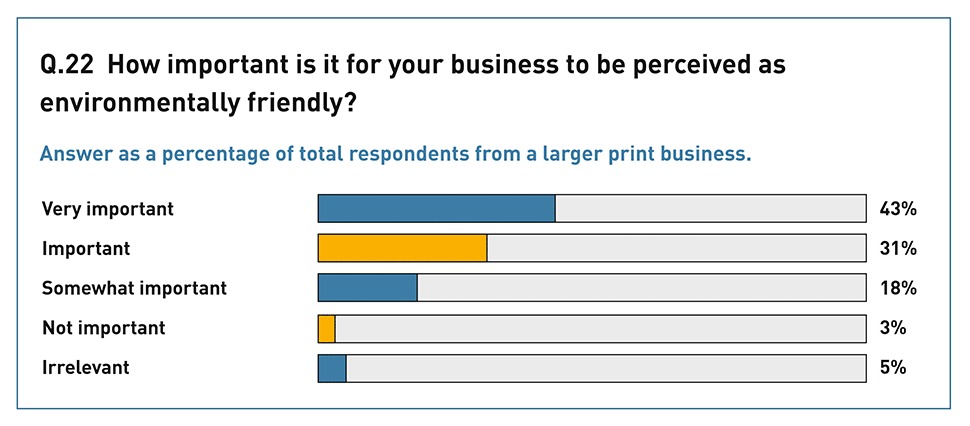

The survey also shed light on ‘Environmental Considerations’ and how evolving customer demands are changing the way print companies operate. Interestingly, while sustainability has become a major focus for all manufacturers and suppliers, there was a significant difference in responses from print service providers based on their size and revenue.

Print businesses employing more than 11 staff and reporting revenue above €1,000,000 see environmental considerations as important to their business, with 74% saying it was either Important or Very Important. Only 8% of larger print businesses said environmental considerations were either unimportant or irrelevant.

On the flip side, responses from smaller micro print businesses (fewer than 10 staff, and revenue below €1,000,000) showed 36% felt that environmental considerations were unimportant or even irrelevant to their business.

The obvious conclusion to draw is that the larger the print business, the higher the probability that demands from corporate clients and brands with ESG considerations become a determining factor.

As to the steps companies are taking to improve their environmental sustainability, all respondents had put in place some form of energy reduction initiatives. Almost all followed guidelines to reduce hazardous waste, while most respondents advised their customers on the availability of sustainable products.

To view the full results of the survey in detail, please click here to download the PDF.