Events

Esko will host its first in-person Innovation Summit of the year next month, giving packaging professionals from across the industry the unique opportunity to interact and discuss how to overcome the challenges of today - and prepare for those of tomorrow.

ADAPT - Amari Digital Printing Technologies, part of the Vink group, has announced a series of free-to-attend, interactive events, dedicated to showcasing the leading solutions from media manufacturer Mactac, alongside a wide range of accessories and tools.

Signage and visual communications specialist, FASTSIGNS Peterborough, is celebrating a strong year of successes, following its relocation to Phorpres Close last October and a string of recent new appointments.

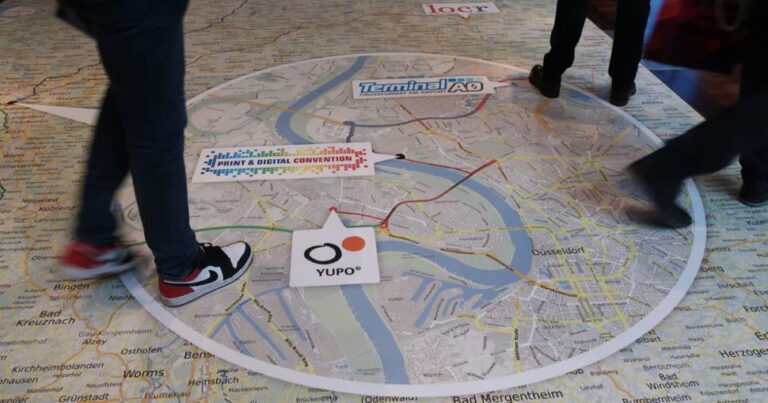

The fourth edition of PRINT & DIGITAL CONVENTION, organised by the Fachverband Medienproduktion (f:mp.) and Messe Düsseldorf, came to an end with around 800 participants on two days of the trade fair.

The ISA-UK powered by BSGA, the leading independent trade association for the UK sign, graphics and visual communications industry, is delighted to announce the appointment of Chris Coward as its new General Manager, with immediate effect.

JETRIX printers are known for the versatility of the medias they can work with and now Brett Martin have recognised this by awarding them an Approved Partner status.