Events

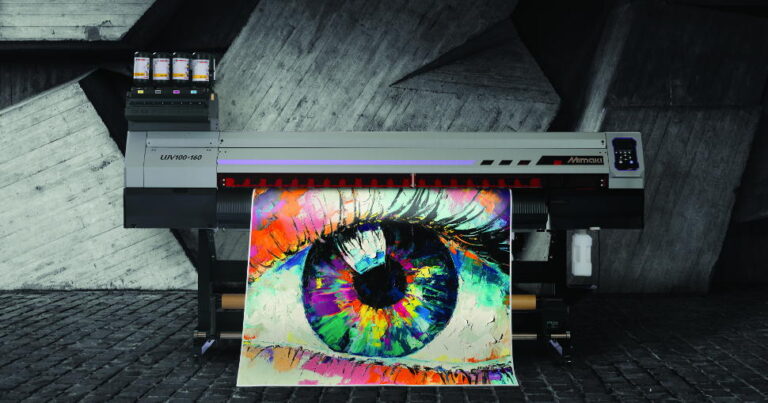

Mimaki Europe has today announced that it will exhibit its broad portfolio of cutting-edge digital print technologies at the first ever virtual drupa (20-23 April 2021).

PRINTING United User Experience (PRINTING United UX), a new, multi-faceted event experience powered by PRINTING United, today announced that PrintAmerica has joined PRINTING United UX, a customizable meeting venue being held just prior to the PRINTING United Expo in Orlando.

After a three-month transition period with his predecessor Herbert Forker, Dr. Nicolas Wiedmann has assumed full responsibility as Siegwerk's new Chief Executive Officer (CEO). He joined Siegwerk on January 1, 2021 and has been intensively involved with the company since then.

Ricoh today announced that Carsten Bruhn is now the President and CEO of Ricoh North America.

PRINTING United User Experience (PRINTING United UX), a new, multi-faceted event experience powered by PRINTING United, today announced that EFI has signed on as a participant to host a paid training event for customers attending PRINTING United on some of the company’s latest technology.

Mack-Brooks Exhibitions has today announced the postponement of ICE Europe, CCE International and InPrint Munich.