Appointments

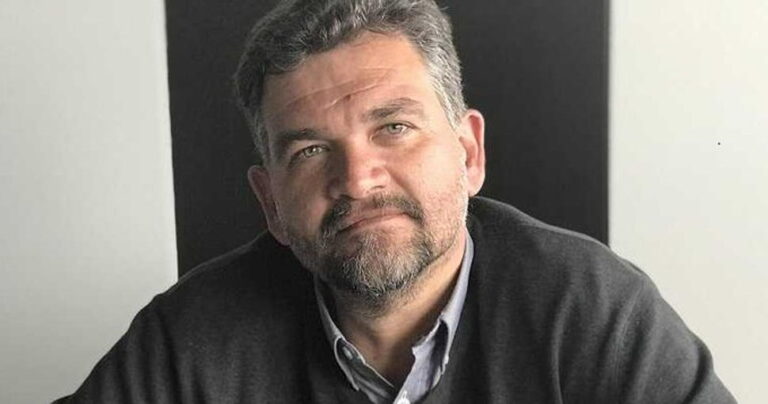

PrintFactory announces further expansion of its sales channels with the appointment of Angel Jiménz Gil as Sales Manager for the Iberian market from 1 October 2021.

CMYUK has announced the four graduates who have been chosen to participate in its Creatives in Residence Live initiative.

Drytac has announced the appointment of Don Valenzuela to its US Sales Team as Regional Manager for the West Coast Territory, covering Washington, Oregon, California, Arizona, Nevada, and New Mexico.

The very best in packaging for premium markets including drinks, beauty, and gifting will be on display for industry professionals to discover when Luxury Packaging, co-located with Packaging Innovations, returns to London’s Olympia on 1 & 2 December 2021.

With the undoubted rise in eco-consciousness, sustainability should now be at the heart of print service providers (PSPs)' business operations. HP is launching a series of online events to support PSPs on their sustainability journey.

Roland DG is excited to be attending FESPA Global Print Expo 2021, showcasing brand new solutions alongside some of the company’s most popular machines and technologies for print professionals.