Events

Onyx Graphics, Inc., a pioneer in wide-format digital printing solutions and RIP software, is excited to announce a series of product demonstrations and advanced feature training sessions for its latest RIP software, ONYX 24, and the newly enhanced ONYX Align at Printing United 2024.

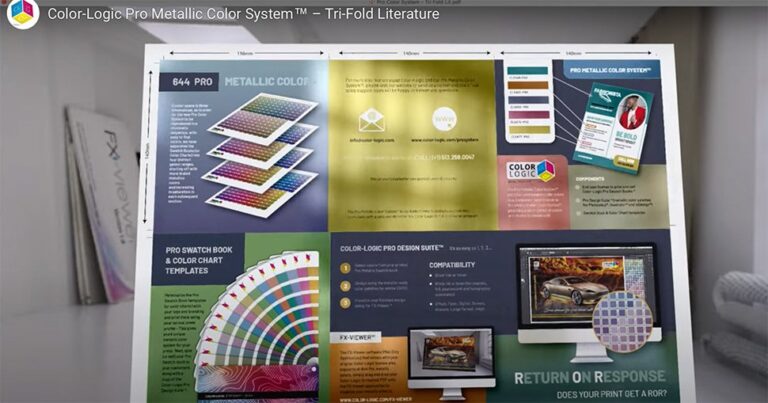

In the Sharp Electronics booth at PRINTING United expo in Las Vegas, September 9-12, show attendees can see live demonstrations of the Color-Logic metallic system.

Under the banner of “Finishing well starts with Tecnau”, Tecnau is excited to bring to PRINTING United Expo Booth C513 a pair of finishing systems incorporating powerful labor-saving automation features.

Taking place from September 17th to 19th in Hall 17 of the NEC, Birmingham, The Print Show 2024 has garnered a real buzz due to the calibre of new and returning exhibitors.

Industry professionals from the print and graphics sectors are cordially invited to a premier event on October 2, 2024, hosted by Zund UK.

Manufacturer of PVC-free wide format materials Kavalan will demonstrate the quality, printability, and weldability of its products through its partnerships with leading manufacturers and suppliers at PRINTING United Expo 2024, including its distribution partner Media One.